New Decentralized Cryptocurrency Trading Bot Hits the Market

The Rise of Decentralized Cryptocurrency Trading Bots

In the dynamic world of cryptocurrency trading, investors are constantly seeking innovative tools and strategies to gain an edge in the market. One such tool that has gained significant popularity in recent years are cryptocurrency trading bots. These automated systems leverage algorithms to execute trades on behalf of users, aiming to capitalize on market trends and fluctuations. While centralized trading bots have dominated the scene, there is a growing need for decentralized alternatives that offer enhanced security, transparency, and autonomy.

The Promise of Centralized Trading Bots

Centralized trading bots have been widely embraced by cryptocurrency enthusiasts for their ability to execute trades swiftly and efficiently in hopes of locking in gains automatically. These bots are typically hosted on centralized servers, allowing users to access their services through a web interface. Centralized platforms offer convenience and a user-friendly experience, making them accessible to traders of varying expertise levels.

However, centralized trading bots come with their fair share of challenges. Investment in the latest and greatest robot can be costly, in the range of $500–3,000, and a huge barrier. The learning curve takes focus, and learning the proper setups is time-consuming. The wrong setup and you can wipe out an account. Security remains a significant concern, as users are required to trust the platform with their sensitive trading information, including API keys and personal data. Hacks and security breaches have been reported, highlighting the vulnerabilities inherent in centralized systems. Additionally, the lack of transparency can lead to doubts regarding the fairness of trade execution and the integrity of the platform.

The Need for Decentralization

In response to these challenges, the cryptocurrency community is increasingly recognizing the advantages of decentralized trading bots. A decentralized trading bot operates on a blockchain, utilizing smart contracts to execute trades in a trustless and transparent manner. By eliminating the need for a central authority, decentralized trading bots address security concerns and foster greater user control over their assets.

Decentralization brings with it enhanced security, as users retain ownership of their private keys and trading data. This reduces the risk of unauthorized access and provides a more secure environment for traders to execute their strategies. Furthermore, the transparency afforded by blockchain technology ensures that trade executions are verifiable and tamper-proof, instilling confidence in users regarding the integrity of the trading process.

Jonny Blockchain's New Decentralized Exchange Robot Trader

Jonny Blockchain (JB) began like most bots, allowing Centralized Exchange trading. They proved their trading over the last 3 years and began building a version of their bot to work on a DEX.

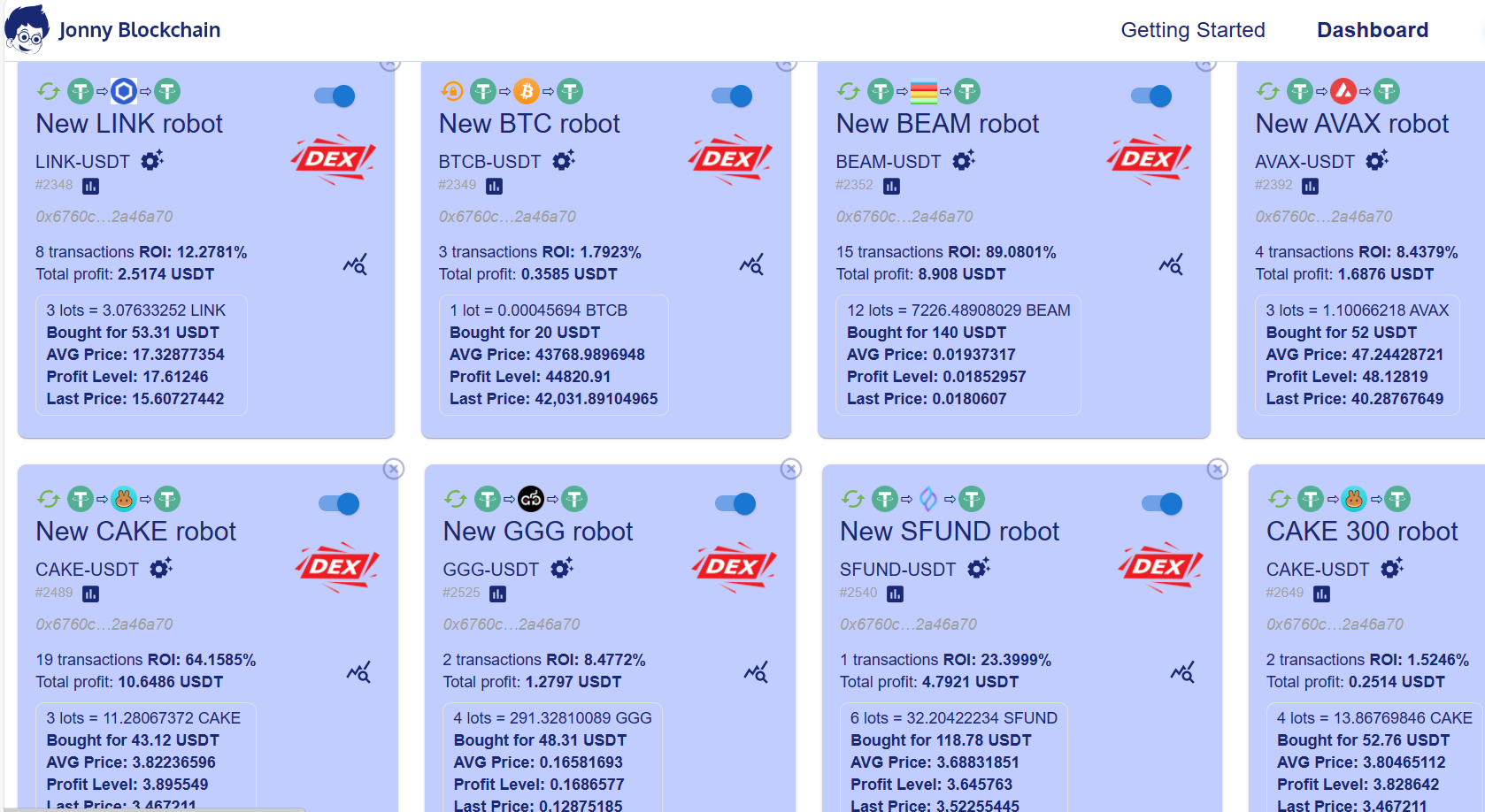

Jonny Blockchain DEX bot opened to the public at the beginning of December 2023, and the results are impressive. We opened a fresh MetaMask wallet on the BNB Smart Chain to trade on PancakeSwap since it has huge liquidity and low fees. We loaded it with mostly USDT and a little BNB for fees. We plugged into the JB community on Telegram to see what was working best for trades. There are a variety of tokens to choose from. The more volatile tokens work the best within the bot. The default settings work great too. Just tweak the percent allocation for your particular token bot compared with how many bots you want to trade and the total USDT budget you have to work with. We started with $400 and the bot got to work. For example, we set up the bots ranging from $100-$200 allocation. Each trade is picking up smaller positions from $6-$40 and selling them after an uptrend is reversed.

Take a look at the screenshots below.

New Paragraph

Autonomy and Empowerment

Decentralized trading bots also empower users by granting them greater autonomy over their trading activities. Users maintain control over their funds, and the smart contracts governing the bot's operations are executed automatically without the need for intermediaries. This not only streamlines the trading process but also reduces the dependency on third-party platforms.

The decentralized nature of the Jonny Blockchain bot aligns with the core principles of cryptocurrency - decentralization, censorship resistance, and democratization of financial systems. Users are no longer subject to the rules and regulations of a centralized entity, fostering a more inclusive and open financial ecosystem.

The rise of decentralized cryptocurrency trading bots, like Jonny Blockchain, represents a paradigm shift in the way traders engage with the market. With heightened security, transparency, and user autonomy, decentralized trading bots offer a compelling alternative to their centralized counterparts. As the cryptocurrency landscape continues to evolve, the demand for decentralized solutions is likely to grow, shaping the future of automated trading in a decentralized and trustless manner.

It is great to see a great product from Jonny Blockchain that solves a big problem. Their first-mover advantage should position them for success and help them continue to innovate and help more traders.

Jonny Blockchain Marketing Model

Their goal is to grow organically through word of mouth, and like most decentralized models, they want to reward the community for sharing their platform and their story with other users. Of course, they built a referral model to incentivize sharing with others.

Take a look at the details here:

To access the trading bots there is a connection fee of:

$25 USDT for one year to DEX Trading MetaMask connection.

As an Affiliate, you can get a commission on the connection fee and profitable trades over 4 levels (see below); these commissions will show in the "Wallet Statement".

Your Directs:

Level 1–30%

Your Indirects:

Level 2–5%

Level 3–3%

Level 4–2%

Profitable trades:

Every time a trading robot earns a profit there is a Software Service Fee (SSF) of 25%. Their model is 75/25 split on profits only. They harvest 25% of profits from your JB Top Off Wallet after one week - 60% of this profit goes to JB. The remaining 40% is shared back to referring affiliates.

As an Affiliate you can get commission over 4 levels (see below), these commissions will show in the "Wallet Statement"

Your Directs:

Level 1–30%

Your Indirects:

Level 2–5%

Level 3–3%

Level 4–2%

Start a FREE Account here:

This is a redirect to our referral link on Jonny Blockchain.

This is not Financial Advice. Trading cryptocurrency involves risk. Do your research and seek professional advice when needed.

LEAVE A MESSAGE